Ethereum Automation Guide

Learn how to automate Ethereum transactions and workflows with Ava Protocol’s detailed technical documentation.

Introduction#

Ava Protocol is Web3’s hub for cross-chain automation, enabling multi-chain apps to schedule and automate any EVM-based transaction or smart contract function. It delivers trustless automation by dedicating block space and optimizing gas usage to store and execute transactions across connected blockchains.

This automation engine combines off-chain data streams and event-driven execution to trigger transactions on Ava Protocol and connected blockchains — all without handling tokens or private keys. Ava Protocol enables fluid user experiences like scheduled and recurring payments, stable-cost averaging, stop-loss orders, and auto-compounding rewards for staking, liquidity pools, and money market deposits.

Ava Protocol provides automation infrastructure for decentralized applications (dapps) to manage single or recurring transactions using simple "if this, then that" logic.

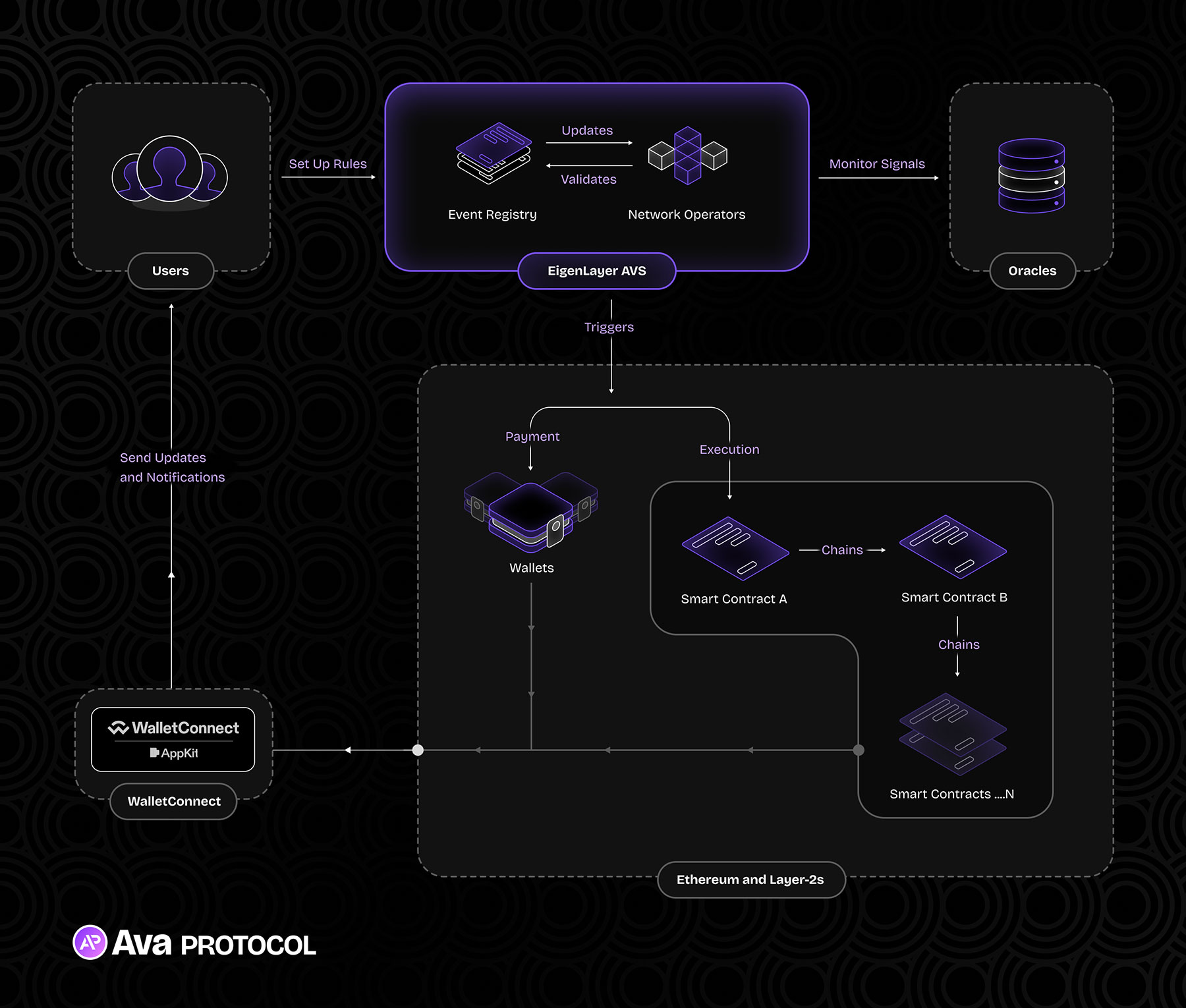

Figure 1: Ava Protocol’s Event-Driven Execution Flow.

Figure 1: Ava Protocol’s Event-Driven Execution Flow.

Below is a breakdown of the automation flow:

-

User Action and Rules Setup: Users first define their desired automated actions and execution rules, which are then translated into steps by the system’s Automation Copilot, an AI-powered workflow builder that combines a large language model with in-context learning. Once the rules are set, Ava Protocol takes over, monitoring conditions and executing the corresponding tasks when they are met.

-

Event Registry and Monitoring: When users set up their workflows, the associated rules and conditions for these actions are logged in the system’s Event Registry, powered by EigenLayer’s off-chain storage and computation. EigenLayer operators are constantly tracking updates to the Event Registry and monitoring signals across connected networks, such as Ethereum and various Layer-2 solutions. They validate whether the conditions for triggering an event have been met.

-

Oracles and Real-World Data: Events can come from many places, like status updates from smart contracts or signals from external APIs or databases. Oracles play an essential role by providing external data inputs to the system. Oracles allow on-chain environments to access real-world information, like real-time price feeds or other off-chain data. Operators monitor signals from oracles to execute transactions based on real-time events, like a scheduled payment or a stop-loss order.

-

Validation and Execution: Once conditions in the Event Registry are validated, operators proceed to execute the automated tasks, such as moving tokens or triggering smart contracts. The design allows for decentralized, autonomous control — tasks are executed without external intervention. The system efficiently manages multiple actions through prioritized execution, ensuring that the triggering of critical actions is timely and secure.

-

Smart Wallets: Ava Protocol’s smart wallet account abstraction works seamlessly with the system’s event-driven automation. Once an event is triggered, the smart wallet bundles actions into a User Operation, as defined by ERC-6900, efficiently handling complex tasks like token swaps in one go.

Modular and Composable Technology Stack#

Ava Protocol’s technical stack offers a suite of robust, customizable, and interoperable tools designed to streamline and secure the development and management of decentralized applications.

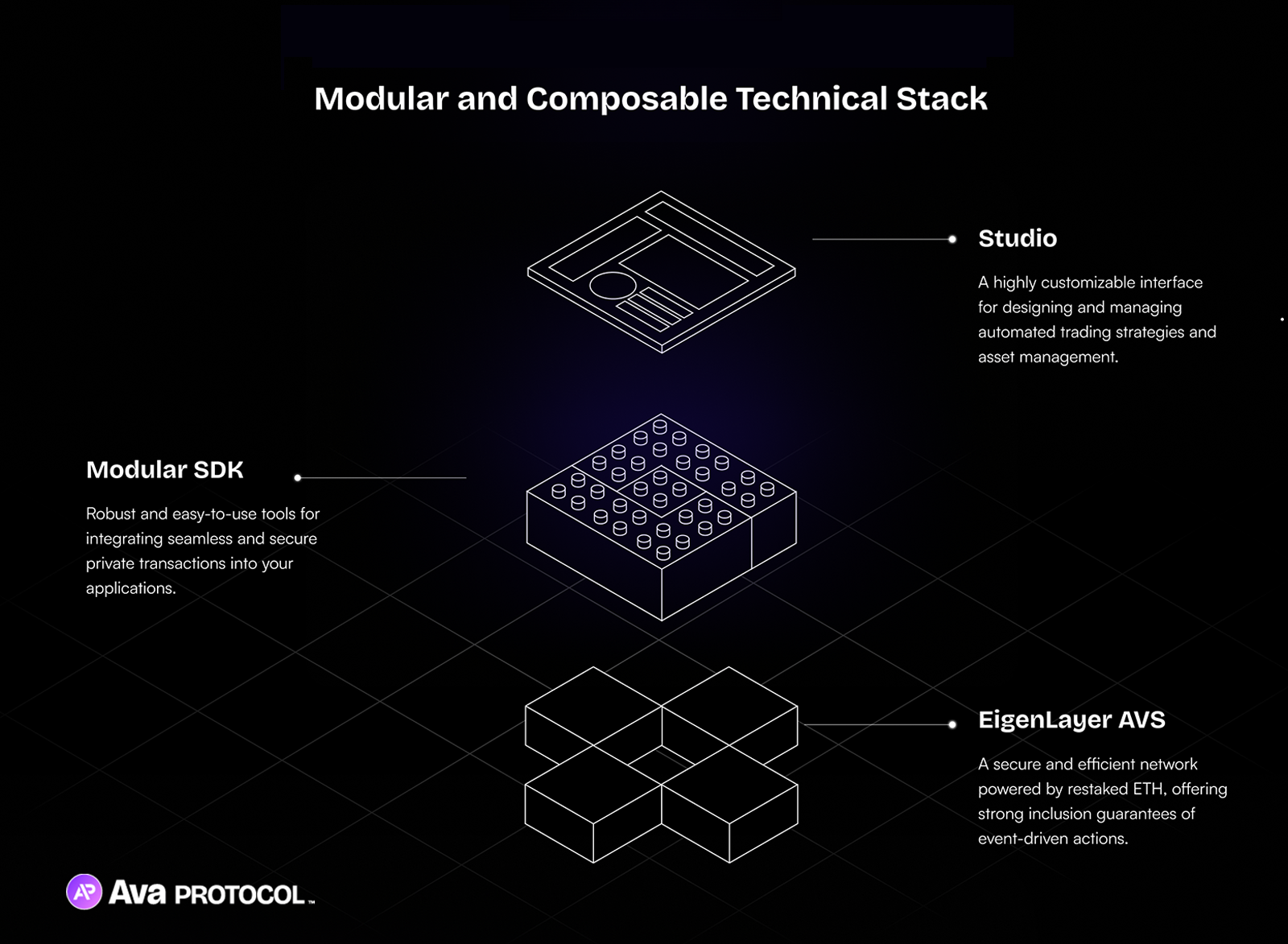

Figure 2: Ava Protocol’s Technology Stack.

Figure 2: Ava Protocol’s Technology Stack.

1. Studio#

The Studio is a highly customizable interface for creating, designing, and managing automated trading strategies and asset management workflows.

Technical Details

- Customization and Flexibility: The Studio provides a drag-and-drop interface that allows users to build and adjust trading strategies without coding. This flexibility lets users tailor strategies to fit specific needs and market conditions.

- Integration with APIs: It integrates seamlessly with various financial data APIs, providing access to real-time and historical market data, along with other essential metrics necessary for informed decision-making.

- Backtesting and Simulation: The Studio offers robust backtesting tools that enable users to test strategies against historical data and evaluate their effectiveness before live deployment.

- Automation and Scheduling: Users can automate their strategies to execute trades based on specific times or market conditions, improving efficiency and responsiveness.

- Security and Compliance: The Studio adheres to stringent security protocols to protect user data and transactions while supporting compliance with relevant financial regulations and standards.

2. Modular SDK#

The Ava Protocol SDK (Software Development Kit) provides modular and easy-to-use tools for integrating seamless and secure private transactions into dapps and services.

Technical Details

- Development Tools: The SDK includes libraries, sample code, and documentation to help developers integrate advanced features with minimal effort. It supports multiple programming languages and platforms.

- Security and Privacy: Built with a focus on security, the SDK ensures that all transactions and sensitive data are encrypted and secure.

- Interoperability: The SDK is designed to be modular and interoperable, enabling developers to build applications that can interact with different blockchain networks and systems.

- Scalability: It supports scalable solutions, allowing applications to handle large transaction volumes without compromising performance. The SDK includes optimization tools to ensure efficient use of resources.

- Community and Support: Developers have access to a community of users and extensive support resources, including forums, FAQs, and direct support channels, making it easy to find help and share knowledge.

3. EigenLayer AVS#

Ava Protocol is an Actively Validated Service (AVS) on EigenLayer, an innovative restaking protocol that leverages Ethereum's pooled cryptoeconomic security.

Why We Chose EigenLayer

- Network Security: EigenLayer utilizes restaked ETH to validate decentralized services, ensuring that the network is secure and resistant to attacks.

- Event-Driven Architecture: Event-driven activation is a key AVS use case supported by EigenLayer, triggering actions for real-time applications based on specific events.

- Off-chain computation and storage: The off-chain resources of EigenLayer operators allow Ava Protocol to tailor data structures for efficient, event-driven activation, providing scalability for complex computations and data management.

- Scalability and Efficiency: EigenLayer is designed to be highly scalable, capable of handling high volumes of transactions and events without performance issues.

- Inclusion Guarantees: The network ensures that all valid transactions and events are included in the blockchain, maintaining integrity and reliability.

- Cross-Chain interoperability: With connectivity facilitated by different AVSs in the EigenLayer ecosystem, such as oracles and bridges, Ava Protocol can validate Layer-2s and EVM-compatible chains, offering automation services to a range of dapps and services.

EigenLayer jumpstarts the launch of Ava Protocol's super-transactions service on Ethereum, rapidly providing a secure network and proof-of-stake consensus method to guarantee the accuracy of automations.

How Ava Protocol Is Different#

- No more wrapped assets:Assets are supported by the chain directly, eliminating the need for them to be locked in a single smart contract.

- Eliminate off-chain servers: Repetitive transactions can be triggered by on-chain event modules.

- No private key custody: Once set up, on-chain transactions can be triggered automatically without further input.

- Chain-level security: Unlike EVM smart contracts, core utility functions are secured by the network.

- Execution guarantees: Users can be assured that their events will reliably execute based on specific conditions.

Ava Protocol Ecosystem#

Ava Protocol has integrated with a diverse range of dapps and services that showcase the versatility and potential of our automation solutions.

Figure 3: Ava Protocol’s Ecosystem and Dapp Integration.

Figure 3: Ava Protocol’s Ecosystem and Dapp Integration.

- Term.finance: A DeFi platform on Ethereum and Avalanche enabling fixed-rate, on-chain borrowing and lending with transparent smart contracts.

- Zoth: A DeFi & RWA platform bridging traditional and onchain finance, offering institutional-grade fixed-income markets for RWAs like trade finance, T-Bills, and bonds.

- DIN Data Intelligence Network: DIN is the first modular AI-native data pre-processing layer, empowering users to prepare data for AI applications and earn rewards.

- Bagpipes: A no-code DeFi automation tool that allows users to create custom cross-chain workflows with ease.

- Mangata X: Facilitating cross-chain trading with minimal slippage and high efficiency.

- YieldBoot on Nova Wallet: Automating yield farming strategies to optimize returns across multiple DeFi platforms.

- YieldBay: Offering auto-compounding solutions to maximize returns for liquidity pool participants.

These dapps leverage Ava Protocol’s advanced features — such as seamless integration with off-chain data, event-driven automation, and secure transaction execution — to deliver exceptional user experiences and drive the next wave of blockchain innovation.